I’m pretty sure that at age 37, I’m currently working my way through my midlife crisis. While at first mention, it might seem I’m getting mine out of the way a little early, consider that the average American man in Tennessee lives to be about 74 years old. So actually, I’m actually right on cue:

If I live that long, then my life is already halfway complete at this point.

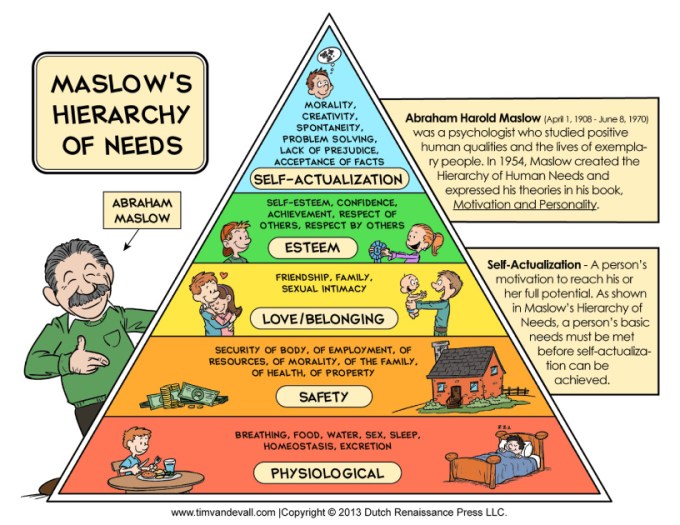

Perhaps the biggest struggle I am sorting out is that, as of this year, I have officially found myself at the top of Maslow’s Hierarchy of Needs: Self-Actualization.

The way I like to explain how Maslow’s Hierarchy of Needs works is this:

If and when you are able to overcome needs in each stage of your life, they are simply replaced by new ones that you didn’t have the privilege of addressing before.

Things started progressing quickly on my journey up the pyramid, in my mid-30s, when I discovered that it was always my decision whether I allowed other people to emotionally affect me. During that same time in my life, my wife and I had become completely debt-free, other than our mortgage.

Now in our late 30s, we have found ourselves in a new income level bracket; having both progressed our ways up the corporate ladder, in addition to the aforementioned pyramid.

I think the identity crisis I am going through right now is that we both work full-time jobs in offices, in addition to side jobs online. The money simply goes to paying off our mortgage, our kids’ college funds, and our retirement.

It’s just sort of demotivating to consider how much of our time is spent working- and how little time is spent together as a family.

Plus, I really want a Jeep Wrangler. I’ve been dreaming about owning one for years. But having gone years without a car payment, and knowing that buying my dream car would only take away from our savings and our ability to pay extra each month on our mortgage, I just wouldn’t be able to enjoy it anyway.

Clearly, I have first world problems. Yet according to Maslow’s Hierarchy of Needs, they are still legitimate challenges that I am sorting out in my life.

This is my midlife crisis at age 37.